Understanding the Rhineland vs. Anglo-Saxon Business Models: Why US SMEs Must Know the Difference

Expanding from the United States into Europe is not simply a matter of crossing the Atlantic and selling the same way you do at home. Many American entrepreneurs discover that what works in Boston, Chicago, or San Francisco does not translate seamlessly in Frankfurt, Amsterdam, or Zurich. One of the reasons lies beneath the surface: Europe operates under a different business logic.

While US companies are accustomed to the Anglo-Saxon model, much of continental Europe operates with a different set of values and structures — the Rhineland model. For small and mid-sized enterprises (SMEs) planning their first steps into Europe, understanding this distinction is not an academic exercise. It is a practical necessity that can determine whether you win your first European customers quickly or face years of frustrating delays.

This blog provides a clear, objective comparison of the two models. We explain what the Rhineland model is, why it matters, and how US SMEs can adapt without losing their own strengths.

The Anglo-Saxon model: shareholder value and speed

The Anglo-Saxon business model is most familiar to American entrepreneurs because it is the foundation of the US economy. Its main characteristics include:

Shareholder primacy

Success is measured primarily in shareholder returns.

Quarterly earnings, stock prices, and investor confidence drive decisions.

Capital markets as growth engines

Equity and venture capital play a central role in financing expansion.

Fast scaling is encouraged and often rewarded.

Flexibility and efficiency

Companies are designed to adapt quickly to changing markets.

Competition is seen as the main driver of innovation.

Centralized management

Decision-making is concentrated at the top.

Boards and executives move fast, with limited consultation beyond investors.

This model rewards speed, risk-taking, and disruption. Many US SMEs thrive in this environment and assume that growth abroad will look the same.

The Rhineland model: stability and stakeholders

The Rhineland model, dominant in Germany, the Netherlands, Switzerland, Austria, and parts of Scandinavia, takes a very different approach. It is built on principles that reflect Europe’s history, social structures, and values.

Key characteristics

Stakeholder orientation

Companies are accountable not only to shareholders, but also to employees, customers, suppliers, banks, and society.

Decision-making balances financial returns with social impact and long-term relationships.

Bank-based financing

Instead of stock markets, banks play a central role in corporate financing.

Long-term credit relationships are common, reducing pressure for immediate returns.

Consensus and participation

Employees often have a formal voice through works councils or unions.

Supervisory boards may include worker representatives, especially in Germany.

Major decisions (like layoffs or relocations) are negotiated, not imposed.

Long-term orientation

Stability, reputation, and trust matter more than quarterly gains.

Companies invest heavily in apprenticeships, training, and supplier relationships.

Embeddedness in society

Firms are expected to take responsibility for communities, sustainability, and the environment.

“License to operate” depends on more than legal compliance — it is about societal trust.

Practical implications for US SMEs

Sales cycles are longer. European buyers expect to build trust before closing deals. A handshake and a demo are rarely enough.

Employees seek security. Workers value clear contracts, benefits, and career development, even in smaller companies.

Suppliers and banks expect reliability. Payment terms, references, and long-term cooperation weigh heavily.

Regulatory compliance is strict. Labor laws, environmental standards, and data privacy rules are taken seriously and enforced.

In short: the Rhineland model is about stability before speed.

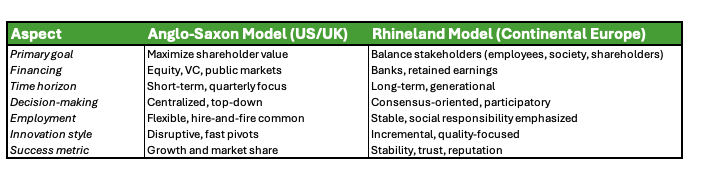

Comparing the two models side by side

Anglo-Saxon vs Rhineland model

Neither model is “better” than the other. Each reflects different cultural, legal, and historical contexts. The challenge for US SMEs is to bridge the gap when entering Europe.

Why this matters for US SMEs

US entrepreneurs often underestimate how much these models shape daily business interactions. Consider a few common pitfalls:

Contract negotiations

In the US, contracts may be signed quickly, with the expectation that details can be adjusted later. In the Rhineland model, contracts are detailed, negotiated carefully, and meant to last. A rushed contract can signal unreliability.Partnership building

US SMEs often pursue quick wins with multiple small clients. European partners, however, look for a supplier who is committed long-term, even if growth is slower.Hiring staff

US companies may prefer flexible contracts or contractors. In the Rhineland system, full-time employment is the norm, and job security is a strong cultural expectation. Offering only flexible contracts can damage your reputation as an employer.Financing and growth

In the US, raising VC funding signals strength. In the Rhineland, banks and customers may view heavy reliance on external capital as risky. They prefer companies that demonstrate financial discipline and stability.

Without adapting, US SMEs risk frustrating potential partners, losing talent, or slowing down their European expansion.

The opportunity: combining both models

The real opportunity for US SMEs is not to abandon the Anglo-Saxon mindset, but to blend it with Rhineland principles. Companies that manage to do this often gain a competitive edge:

Anglo-Saxon strengths: speed, innovation, scaling capacity, entrepreneurial spirit.

Rhineland strengths: trust, resilience, sustainable growth, loyal relationships.

When combined, they create a powerful formula: the agility of US companies plus the credibility of European partners.

How Peakscale Consulting supports this transition

At Peakscale Consulting, we specialize in helping US SMEs bridge the gap. Our approach includes:

Cultural translation – we explain how European partners think and how to align your pitch, contracts, and hiring practices accordingly.

Market-entry design – we help you test and validate your first steps in Europe without unnecessary costs or risks.

Stakeholder engagement – we guide you in building relationships that shorten trust cycles and accelerate deals.

Strategic balance – we show you how to retain your Anglo-Saxon strengths while respecting Rhineland expectations.

Our clients tell us this is the difference between spending years “figuring it out” versus winning their first European customers in months.

Want to dive deeper? Join our webinar

We will cover this topic in more detail during our upcoming webinar:

How US SMEs Can Win Their First Customers in Europe — Without Opening an Office

📅 October 30, 2025 | 1:00 pm EST / 10:00 am PST | 45 minutes + live Q&A

And if you are in Atlanta in November, you can meet us in person to discuss your European ambitions and how to bridge the Anglo-Saxon and Rhineland approaches for your company.

Final takeaway

The distinction between the Anglo-Saxon and Rhineland business models is not just theory. It shapes how deals are signed, how employees are managed, how financing works, and how success is measured.

For US SMEs expanding into Europe, ignoring the Rhineland model can lead to frustration and delays. Understanding it — and learning how to blend it with your Anglo-Saxon strengths — creates a path to faster, more sustainable growth.

At Peakscale Consulting, we know this landscape inside and out. We help US SMEs translate ambition into action, so you can focus on what matters: winning your first European customers.

📌 Next step: Register for the webinar and let’s start bridging the gap together.